CEST, or Check Employment Status for Tax for those not in the know, has been widely critiqued in the media. We take a look at it in the more detail.

What is CEST?

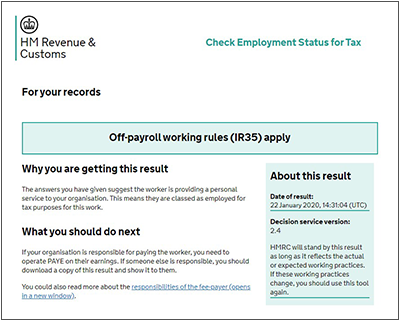

It’s HMRC’s tool to assess off-payroll working assignments. The tool is hosted on the Gov.uk website, and as a separate IR35 status determination will be required for each assignment, the form can be completed multiple times.

To determine IR35 status a series of questions are asked to evaluate whether the assignment is In or Out of Scope, with the option to download a full report to pass on to the contractor.

The tool has been around for some time and is already being used for Public Sector assessments.

Who can use the tool?

The assessment can be completed by the End Client, contractor or agency – but only the End Client can make the official IR35 status determination.

If challenged the End Client will have 45 days to review the status determination and share the outcome of their investigation with the contractor (and where applicable the Fee Payer) detailing why they have come to this determination. During this investigation period, the original status remains in place.

What’s all the talk about?

It’s had wide criticism, most commonly the ambiguity of some of the questions that make it difficult for End Clients to have confidence in the determinations.

HMRC have reviewed and updated the tool, however some companies are abandoning it in favour of other external assessment software.

Do I need to use CEST to make an IR35 status determination?

Technically no, although if a status determination you make is challenged by HMRC it may not be in your favour if you haven’t used their tool.

That’s why we suggest that CEST is utilised as part of your IR35 evaluation process. It’s important to remember though that HMRC will be looking to see if reasonable care has been taken to make IR35 status determinations, so it’s a good idea to engage external stakeholders such as your recruitment agency (Fee Payer) when evaluating IR35 status as well as CEST. Where you can evidence that due care was taken to make a determination, this will help your case if action is taken against you.

Will HMRC stand by CEST determinations?

Yes, as long as the information entered into the system is accurate. As with any system, the results are only as a good as the data you put in.

If the information provided is checked and found to be incorrect, or has been contrived, then they will consider taking financial and potentially legal action.

With any IR35 status determination, it will be crucial that businesses fully train any personnel making IR35 evaluations – and ensure they have first-hand knowledge of the working practices of the contractor and the contractual agreement.

Find out more

If you’d like to arrange an IR35 contractor workforce review then contact NRL at IR35@nrl.co.uk or find out more on the link below.

.png)